Travel Expense Management Software Explained: From Trip Planning to Reimbursement

Managing business travel today involves more than simply booking tickets and filing receipts at the end of a journey. Companies now require better visibility, accuracy, and structure across every stage of employee travel spending.

Travel expense management software plays a central role in achieving this — supporting organisations from pre-trip planning to post-trip reimbursement, and helping them maintain clearer financial control while ensuring a smoother experience for travelling employees.

In recent years, organisations have increasingly prioritised structured expense governance and automation in business travel processes.

A growing body of industry research indicates that more than half of large enterprises accelerated their adoption of digital expense and reimbursement systems between 2023 and 2025, driven by the need for better audit readiness, policy consistency, and transparency across employee-submitted travel costs.

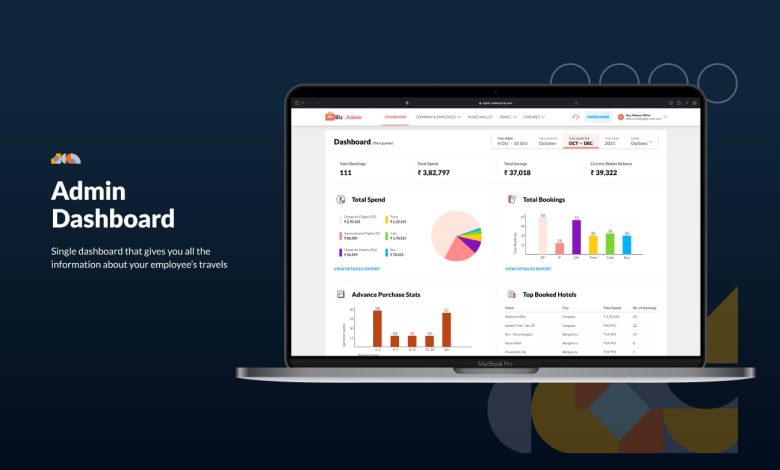

Many businesses integrating automated reporting, approval mapping, and unified expense dashboards have seen measurable operational improvements. Capabilities such as consolidated expense categories, simplified employee onboarding, and policy-aligned submission flows help reduce manual errors and strengthen accountability — particularly for finance teams managing large volumes of recurring travel activity.

In this article, we explore how expense technology strengthens business tourism ecosystems by supporting smarter, structured management of costs before, during, and after a business trip.

What Travel Expense Management Software Does

Travel expense management software brings together travel bookings, expense capture, approvals, and reporting within a single digital framework. Instead of working with scattered spreadsheets, emails, or manual claims, organisations manage everything through one connected environment.

The software links employees, finance departments, and travel administrators, ensuring that expense submissions remain consistent, traceable, and aligned with internal policies. This unified approach improves collaboration, reduces duplication of effort, and creates a structured financial trail for every business journey.

Before the Trip — Planning and Policy Alignment

Before any booking takes place, travel expense management software supports pre-trip estimates, budget visibility, and policy-based approvals. Employees can submit projected travel plans, review permitted cost limits, and receive structured guidance before confirming reservations.

This early visibility helps organisations prevent unnecessary spending, avoid last-minute booking premiums, and ensure that every trip aligns with approved business objectives. When employees start their journey with clarity around budgets and expectations, it becomes easier for both travellers and finance teams to maintain discipline across the entire expense lifecycle.

During the Trip — Recording Expenses in Real Time

During travel, employees can capture receipts, log expenses, and classify transactions as they occur, rather than waiting until the trip concludes. This reduces the risk of misplaced bills, inaccurate entries, or forgotten costs. Real-time recording also helps finance teams monitor ongoing spending instead of reviewing everything retrospectively.

With clearer visibility during the journey, administrators can respond faster to anomalies, policy deviations, or sudden cost fluctuations — enabling better alignment between on-ground travel activity and organisational expense controls.

After the Trip — Verification and Reimbursement

Once the journey ends, automated workflows verify claims, match submissions against travel policies, and streamline approval routing. Supporting documents remain centrally stored, and expense records are automatically structured for auditing and reconciliation.

This leads to faster, more transparent reimbursements for employees, while organisations maintain stronger accountability and traceability. Instead of lengthy manual checks, finance teams benefit from audit-ready records, structured expense categorisation, and clearer insight into how travel budgets are being utilised across departments.

Financial and Operational Advantages for Businesses

From a strategic perspective, travel expense management software strengthens financial governance, improves budget control, and enhances spending transparency.

By operating as a centralized expense management system, it allows organisations to identify recurring cost trends, compare travel patterns across teams, and make more informed decisions when negotiating future travel arrangements. Oversight also reduces administrative workload and enables companies to manage corporate travel as a structured financial process rather than a fragmented operational task.

Technology as an Enabler of Smarter Travel Spending

Digital capabilities — including automated expense categorisation, analytics dashboards, and real-time expense tracking — transform raw data into meaningful financial insight. Technology-driven visibility allows organisations to manage travel programmes proactively instead of reacting to expenses only after reimbursement.

Platforms like myBiz help businesses integrate bookings, expenses, and approvals into a single, transparent system, supporting stronger governance and more confident financial decision-making.

Conclusion

Travel expense management software creates a structured, accurate, and efficient way to manage travel-related spending across the entire journey lifecycle. By improving transparency, strengthening policy alignment, and making reimbursements smoother, it helps businesses balance cost control with a better, more reliable travel experience for employees.